Levy on Bank Account: Understanding Your Rights and Options for Tax Relief

If you find yourself with a mountain of tax debt and unable to pay it back, one of the measures that the IRS can take

If you find yourself with a mountain of tax debt and unable to pay it back, one of the measures that the IRS can take

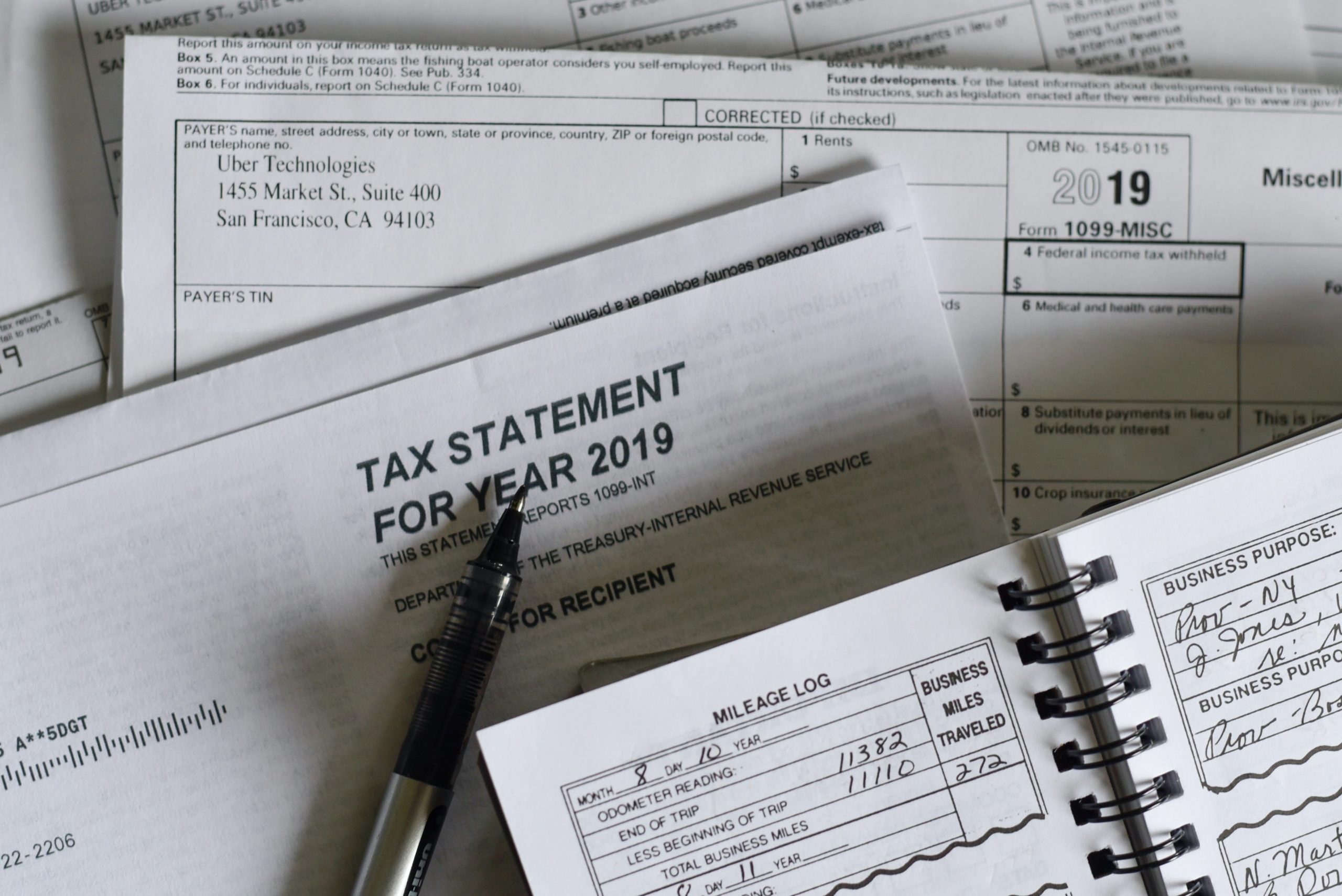

It’s important to know how to file unfiled tax returns to avoid further problems with the IRS. As we know, filing taxes on time is a responsibility that every taxpayer has to fulfill. However, sometimes life can get in the way, and you might miss the deadline to file your taxes.

Want to know what are the four types of innocent spouse relief? Check out our blog to learn how they can help protect you from tax liability and more.

Get tax relief through Innocent Spouse Relief. Learn about qualifying, types available, and more in this blog post. Contact Andrin Tax Relief for help.

If the IRS is coming after you for your tax debt, you may be wondering if you need to hire a tax attorney to resolve

Having IRS debt is a stressful and overwhelming experience. The thought of dealing with the government and paying back a large sum of money can

If you’re worried about a looming tax bill, never fear: there are measures you can take to ensure that your taxes don’t unexpectedly balloon. From budgeting tips to what to do when the worst happens, these strategies will have your wallet breathing easy throughout the year!

When a taxpayer is behind on their federal taxes, they are at risk of having an official public notification filed against them. This document is known as a Notice of Federal Tax Lien and can cause consequences for the individual’s ability to enjoy any financial security.

The tax-filing deadline will be here before you know it and pretty soon, you’ll be gathering up your receipts and plugging in numbers. I know you’re hoping for good news, and praying for a big refund in the process.

Paying taxes is a fact of life, but when the amount is excessive, you may not have the funds to pay in full. Making a mistake on your taxes can be costly as well, and if you plug in the wrong numbers, the IRS will surely come calling.

The IRS Offer in Compromise (OIC) program gives some taxpayers the chance to settle their tax debt for less than they owe. Because it sounds

If you’re a homeowner in Illinois, there’s a good chance you’ve heard about the Illinois property tax credit. Still, many people aren’t sure what it

Getting hit with an IRS penalty for the first time can feel overwhelming—especially if you’ve always tried to stay on top of your taxes. Whether