Wrapping Up 2024: Essential Tax Moves to Make Before December 31st

As 2024 comes to a close, the holiday season isn’t just a time for celebrations—it’s also your last opportunity to make tax-smart moves that could

As 2024 comes to a close, the holiday season isn’t just a time for celebrations—it’s also your last opportunity to make tax-smart moves that could

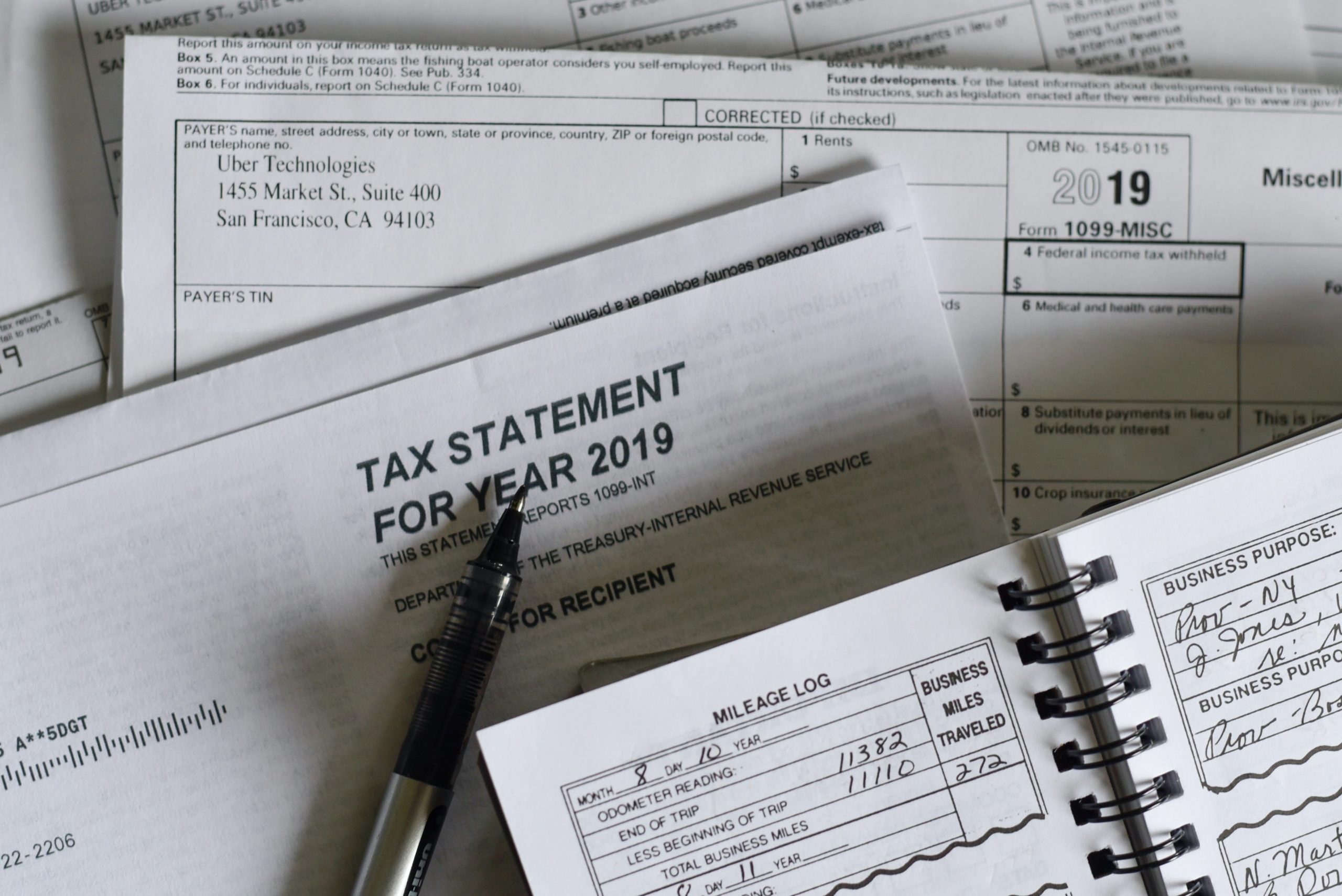

The tax-filing deadline will be here before you know it and pretty soon, you’ll be gathering up your receipts and plugging in numbers. I know you’re hoping for good news, and praying for a big refund in the process.

Paying taxes is a fact of life, but when the amount is excessive, you may not have the funds to pay in full. Making a mistake on your taxes can be costly as well, and if you plug in the wrong numbers, the IRS will surely come calling.

If you are still waiting on your tax refund long after filing, you are not alone. More taxpayers each year are finding that what was

As the 2025 tax filing season approaches, many taxpayers are preparing to file while still carrying unpaid tax balances from previous years. This situation is

When a tax problem comes up, many people assume they need to hire a tax lawyer right away. It is an understandable reaction because IRS